AI and APIstax: The Perfect Match for SaaS Development

AI Dreams It. APIstax Does It. Together, They Transform Your SaaS.

Why waste time building basic features? AI adds intelligence—extracting data, personalizing content, and predicting trends. APIstax delivers action-generating PDFs, validating addresses, and processing payments—fast, reliable, and hassle-free. The result? A smarter, leaner SaaS that scales effortlessly.

Introduction to Using APIstax APIs

APIstax offers a range of secure and reliable APIs designed to meet your business needs, from creating PDF files to checking VAT IDs. In this blog post, we will walk you through the initial steps of working with these APIs.

ZUGFeRD and Factur-X: A Comparison of Electronic Invoicing Standards

In the digital transformation, electronic invoices play a central role. Businesses and authorities worldwide are looking for efficient, compliant, and standardized solutions to optimize invoice delivery. In Europe, two formats ha...

The Benefits of EPC QR Codes for Businesses: Streamlined Payment Processing

In an ever-evolving world of payment transactions, EPC QR codes offer businesses an efficient and reliable solution for payment processing. By integrating EPC QR codes into their payment systems, businesses can leverage a variety of benefits that help optimize payment processes, improve user experience, and reduce operating costs.

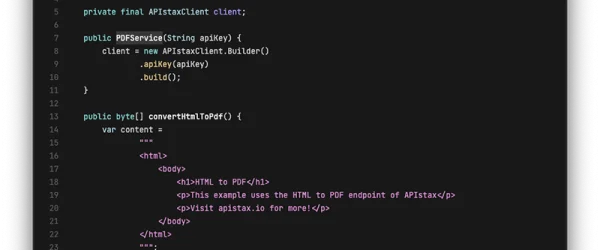

How to generate a PDF in my SaaS project?

There are many ways to create a PDF document, all of which have advantages and disadvantages. However, for SaaS projects, one option lends itself best.

Reduce time-to-market drastically

If you are building a SaaS project or a mobile application, time to market is critical. The sooner you can release new features, the better. However, quality must not suffer as a result of an early release. So what is the key to getting new software to market efficiently?

Digital Sovereignty in Europe: Why European Alternatives Are Essential

It’s All About ControlIn today’s interconnected world, digital sovereignty is not just a buzzword—it’s a necessity. For European businesses, relying on non-European digital infrastructure can mean compromising on data privac...

Swiss QR Invoice: An Innovation in Payment Transactions

In today's business world, efficiency is a crucial factor. The Swiss QR invoice is an innovation that has revolutionized payment transactions. In this blog post, learn more about the Swiss QR invoice, its advantages, technical aspects, and it...

The Benefits of E-Invoicing Using ZUGFeRD

Digitalization is transforming how companies manage their invoicing processes. Traditional paper invoices and simple PDFs are increasingly being replaced by electronic invoices, offering significant advantages.

REST vs. GraphQL: Choosing the right API architecture

In the world of web development, choosing the right API architecture is critical to building efficient and scalable applications. Two popular options that developers often consider are REST and GraphQL.

Generate a SDK client using OpenAPI

Using OpenAPI to generate client SDKs provides a number of benefits that can significantly improve or accelerate development processes.

What is an EPC QR Code?

EPC QR Codes, also known as GiroCodes, are widely used QR codes for initiating SEPA credit transfers. It's the fastest way to share your payment information with a third party.

100 credits for free!

The first 100 credtis are free! No credit card required! Start using all the APIstax APIs now and save countless hours of development time!